- Our offer:

Moreover, PILOT SAAM is an offer insured by SWISS LIFE, one of Europe's leading comprehensive life and pensions and financial solutions providers. More than four million customers place their trust in their products and services.

You can get some more information about SWISS LIFE by clicking here.

You can also remain covered in case of death/TILA until the age of 75 years old.

As soon as you find a job, your trainee pilot coverage ceases and you have to contact us in order to change your insurance policy to a professional pilot insurance contract.

- All-cause death & Total and Irreversible Loss of Autonomy coverage:

Up to 110,000€ for a trainee pilot.

For example: Paul is a professional pilot, his annual gross salary is 75,000€, he can get insured for a maximum sum insured of… 5 * 75,000 = 375,000€

- Day to day expenses;

- Scholarship fees;

- Loan reimbursements;

- Etc.

- Permanent loss of licence coverage:

- Professional pilot: Up to 600,000€ within the limit of 5 times your annual gross salary;

- Trainee pilot: Up to 110,000€.

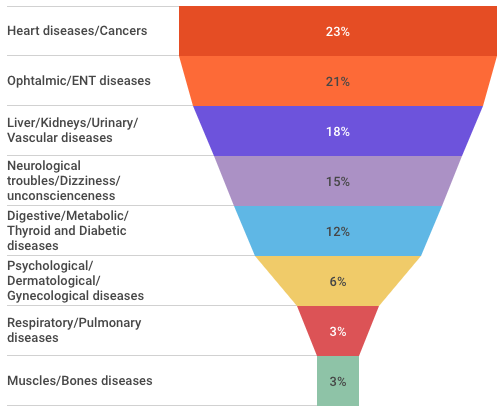

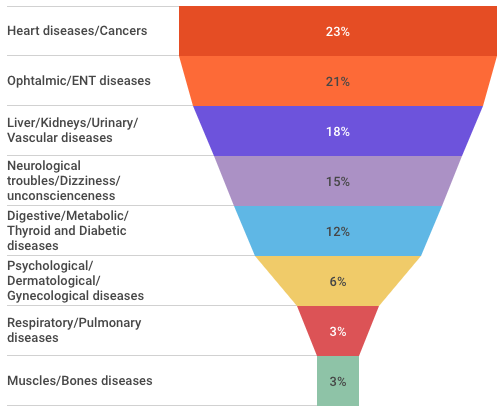

Main loss of licence causes:

Our permanent loss of licence coverage offers you a sum insured that helps you financing:

- Your training;

- An alternative career;

- The payment of a loan;

- Scholarship fees;

- Etc.

- Temporary loss of licence coverage:

For example: Paul is a professional pilot, his annual gross salary is 75,000€, he can get insured for a maximum sum insured of… 75,000/365 * 80% = 164€/day.

You also choose one of the following excess periods:

- 30 consecutive days in case of illness or accident;

- 60 consecutive days in case of illness or accident;

- 90 consecutive days in case of illness or accident.

Main loss of licence causes:

Our temporary loss of licence coverage offers you daily indemnities compensating your income losses and helping you facing your day to day expenses.

When the definitive withdrawal of medical fitness or authorization to work as flight crew occurs after a state of Temporary Unfitness, for a same cause, illness or Accident as that which caused the Permanent loss of licence, the daily allowances paid by the Representative in this respect shall not be deducted from the amount of capital to be paid.

Option B: Deduction of the daily allowances paid by the Representative from the Permanent loss of licence capital.

When the definitive withdrawal of medical fitness or authorization to work as flight crew occurs after a state of Temporary Unfitness, for a same cause, illness or Accident as that which caused the Permanent loss of licence, the capital amount to be paid shall be reduced by all daily allowances paid by the Representative.